Malaysia reintroduced its sales and service tax SST indirect sales tax from. From 1 June 2018 Malaysias Goods and Services Tax will be zero-rated while the Sales and Services Tax is expected to make a comeback.

Railway Ticket Stock Photo 2173809 Shutterstock

GST is charged at standard rate of 0 on the part of work.

. The following table shows the tax code properties required to correctly generate the Malaysia tax reports provided by the International Tax Reports SuiteApp and the Malaysia tax audit files. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced today. The Royal Malaysia Customs Department has issued an FAQ document concerning the recent changes to the GST that include a reduction in the GST rate from 6 to.

Wednesday 16th May 2018. At the same time the Sales Tax Act 2018 and Services Tax 2018 were also tabled to re-introduce the. The ministry of finance had announced.

This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018. Tx 6 gst on purchases. Malaysia scraps GST June 2018.

GST treatment if the tax invoice is issued on 01 June 2018. Zero-rate and continue to comply. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018.

Supplies made between 1 June and 1 September 2018 are. Tax invoice has been. On 31st July 2018 bills were tabled in Dewan Rakyat with the intention of repealing GST.

Why remove GST. The ministry said the GST will no. The new Prime Minister of Malaysia has committed to withdrawing the 6 Goods and Services Tax setting it at zero from 1 June 2018.

The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018. Malaysias goods and services tax gst was repealed on 31 august 2018 and a new sales tax and service tax sst applies as from 1. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 the Finance Ministry announced on 16th May 2018.

After the 2018 election the newly elected Prime Minister Mahathir Mohamad intention to scrap a six per cent Goods and Services Tax GST within 100. With the imposition of the new 0 rate. Decimal 123 Sample value is 50 The unit price exclusive of GST before subtracting item price discount cannot be negative.

Gst tax codes for purchases. Latest GST Ready Reckoner 2022 by CA Raman. GST should be charged at standard rate of 6.

The goods were supplied on 15 June 2018. Effective 1 june 2018 the gst in malaysia will be reduced from 6 to 0. GST Tax Codes for.

May 15 2018 Richard Asquith. Effective 1 june 2018 the gst in malaysia will be reduced from 6 to 0.

Presentation Of The Oecd 2016 Economic Survey Of Malaysia By Oecd Issuu

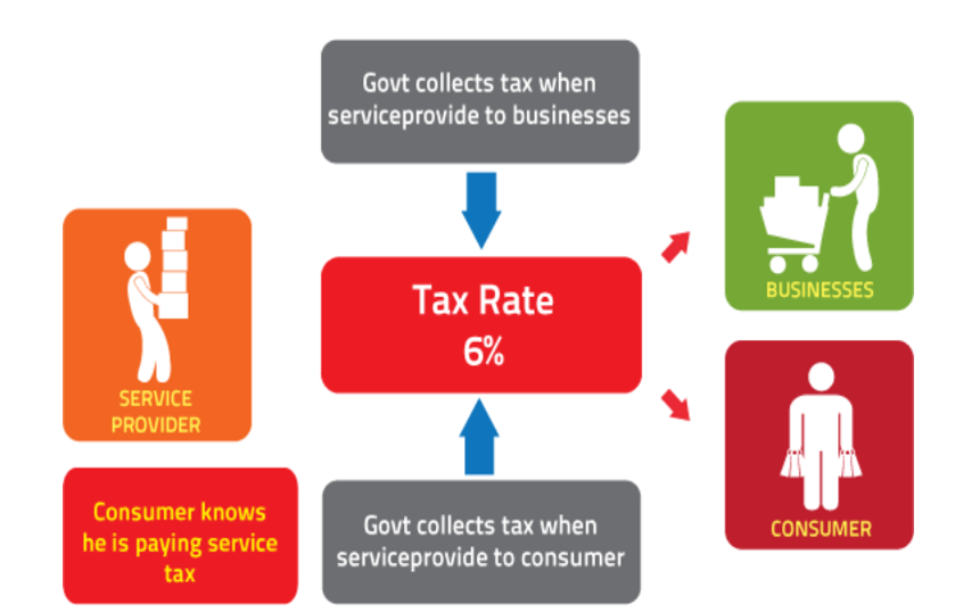

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Singapore Budget 2018 Gst To Be Raised From 7 To 9 Some Time Between 2021 And 2025 The Straits Times

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Snapshot Of Recent Developments Tax Alerts August 2022 Deloitte New Zealand

Gst Related Issues Need Redressal Despite Tax Regime S Benefits Fibre2fashion

Home Currency Adjustment On Reckon Quickbooks Solarsys

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide